Votes for the 288-member state legislative assembly will be counted on November 23, 2024, following a single-phase election on November 20.

On Thursday, November 21, trading will resume on both the NSE and the BSE.

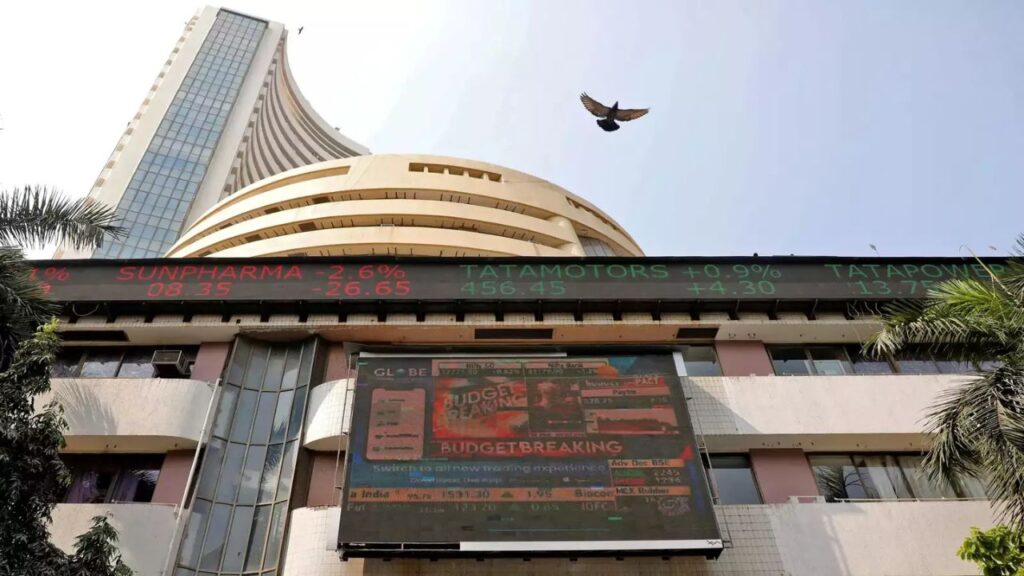

After a seven-day losing skid, the Indian equities markets concluded the turbulent session on November 19 higher, with the Nifty closing at 23,500 due to purchasing in the media, real estate, and automotive sectors.

The Nifty was up 64.70 points, or 0.28 percent, at 23,518.50 at the closing, while the Sensex was up 239.37 points, or 0.31 percent, at 77,578.38.

SBI Life Insurance, HDFC Life, Reliance Industries, Tata Consumer, and Hindalco among the losers on the Nifty, while M&M, Trent, Tech Mahindra, HDFC Bank, and Eicher Motors are among the top gainers.

Media, car, real estate, IT, and pharmaceuticals all had increases of 0.5 to 2.5 percent, while PSU Bank, metal, and oil and gas all saw decreases of 0.5 percent.

The BSE Smallcap and Midcap indices both increased by almost 1%.

“For most part of the trading session, Bulls were in a commanding position but a sudden fall (geopolitical tremors) in the last session erased majority of its gains and the Index closed at 23,518.50 with gains of 64.70 points,” said Aditya Gaggar, Director of Progressive Shares.

Mid and smallcap stocks surged more than 0.90%, indicating that the broader markets performed better than the Frontline Index.

“The Index has developed a DOJI candlestick pattern around the 200DMA. A trend reversal requires a robust, compelling, and long-lasting advance above 23,800, while 23,300 will serve as a solid support, he continued.

The Indian rupee closed Tuesday at 84.41 per dollar, slightly less than Monday’s close of 84.39.