What Is Bitcoin Halving?

The splitting of the Bitcoin mining reward in half is known as the “Halving.” In order to consistently lower the rate at which new bitcoin is introduced, the blockchain’s architects devised a criterion that requires the network to unlock 210,000 more blocks every four years.

The initial payout was fifty bitcoin. Prior dates for halving were:

- Nov. 28, 2012, to 25 bitcoins

- July 9, 2016, to 12.5 bitcoins

- May 11, 2020, to 6.25 bitcoins

The block reward is anticipated to drop to 3.125 BTC in April 2024, marking the next halving.

Only roughly 1.35 million bitcoins remained to be released through mining rewards as of March 2024, out of the approximately 19.65 million bitcoins in circulation.

KEY TAKEAWAYS

- When the reward for mining Bitcoin transactions is reduced by half, this is known as a Bitcoin halving event.

- Halvings lower the quantity of new coins that are available by slowing down the rate at which they are minted.

- On May 11, 2020, Bitcoin experienced its most recent halving, yielding a 6.25 BTC block reward.

- The last halving is anticipated to take place in 2140, at which point there will be 21 million bitcoins in circulation, the theoretical maximum.

Fundamentals of the Bitcoin Network

Understanding the workings of the Bitcoin network is necessary before you can comprehend a halving.

The blockchain, which powers Bitcoin, is made up of a network of computers, or “nodes,” that each run the cryptocurrency’s software and store a partial or full history of all the transactions that have ever taken place on the network.

Every complete node on the Bitcoin network is in charge of approving or rejecting transactions and holds the complete history of all transactions on the platform.

The node verifies that the transaction is legitimate in order to accomplish that. Among these include making sure the transaction is within the allowed duration and has the right validation criteria.

Every transaction is given a unique approval. This is only reported to happen when every transaction in a block has been approved. The transaction is disseminated to other nodes and attached to the current blockchain upon approval.2.

The stability and security of the blockchain are increased by adding more computers, or nodes. On March 5, 2024, 18,830 nodes were projected to be running the Bitcoin code.3. Not all users of Bitcoin are miners, despite the fact that anyone with sufficient storage can join the network as a node and download the complete blockchain and transaction history.

Basics of Bitcoin Mining

The process of using computers or mining hardware to process and validate transactions on the blockchain network of Bitcoin is known as bitcoin mining. Rewards and transaction fees are paid to miners.

Proof-of-work (PoW) is the mechanism that Bitcoin utilizes to verify transaction data. Because it requires time and effort to solve the cryptographic puzzle, it is known as proof-of-work. This serves as evidence that work has been done.

The process of extracting precious metals is referred to as “mining,” not mine in the literal sense. A block is closed and added to a mining queue after it is full with transactions. After being queued up for verification, Bitcoin miners race to discover a number whose value is less than a target that the network has set. The encrypted data from the earlier blocks is all contained in the hash, which is a hexadecimal number.

By validating the transactions within a block, mining creates a new one. Subsequently, nodes do additional confirmations to confirm the transactions. The blockchain is formed by this process, which generates a chain of information-containing blocks.

Bitcoin Halving Effects

The inflation rate

Handling inflation concerns is one of the main ideas for halving the payout. A decline in the quantity of things that a certain amount of money can purchase at any given time is known as inflation. The price of a basket of items is used in the United States to calculate inflation. An economy can tolerate a certain amount of inflation, often 2%, but this is normally a target established by central banks as an objective rather than a number that can be attained.

By reducing the reward amount and preserving scarcity, the Bitcoin Halving aims to counteract any inflationary effects on Bitcoin. The inflationary impacts of the fiat currency, to which Bitcoin must be converted in order to be employed in an economy, are not, however, protected from Bitcoin users by this inflation “protection” mechanism.

Profits realized in relation to market value may safeguard investors against inflation, but they do not serve the purpose of using cryptocurrencies as a payment mechanism.

Demand

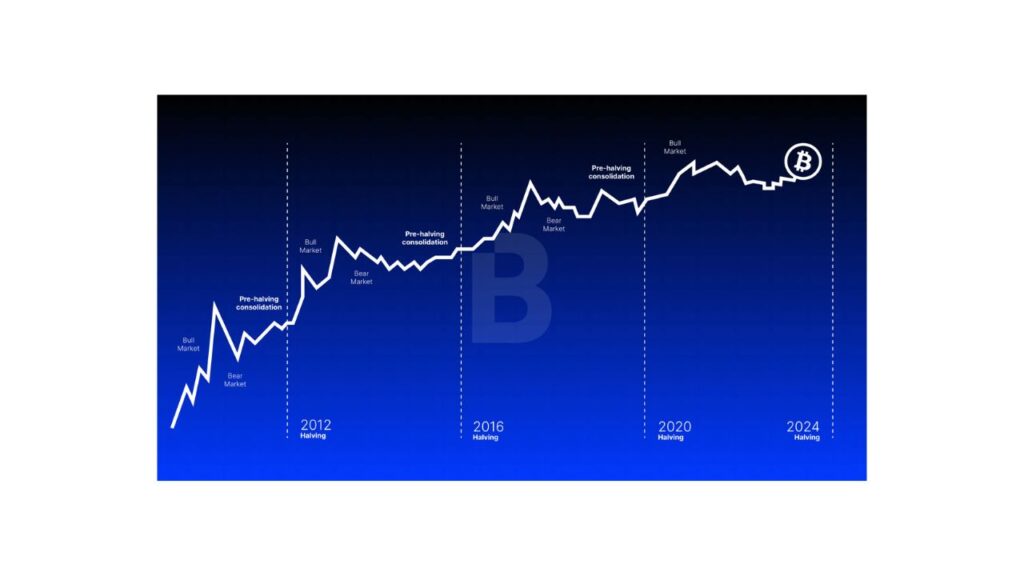

The demand for new Bitcoins typically rises when there is a halving since fewer new Bitcoins are introduced. This is evident from the fact that, following each prior halving event, the price of Bitcoin has essentially increased.

Investing

The purpose of bitcoin was not to be an investment. It was first offered as a payment option in an effort to lessen the requirement for transactions to involve third parties or regulatory bodies.

As soon as investors realized there was a chance for profit, it gained popularity. The cryptocurrency’s creators may not have foreseen the demand created by the flood of investors into the new asset market. If the event’s consequences stay the same, a halving offers investors the prospect of a gain in investment value in addition to a reduction in the number of new coins. However, since Bitcoin investors are looking to make money, this puts Bitcoin investing in the category of speculative activity.

Mining

The persons, organizations, or companies that concentrate on mining for financial gain are known as miners. The miner(s) who earn the reward when new Bitcoins are granted have historically made significant profits. Large mining companies would not have continued to operate if Bitcoin’s price hadn’t varied over time, making it a profitable venture.

But if prices stay the same or decline, halving reduces the mining rewards, making the activity less profitable with each halving. Massive sums of money and energy are needed to operate the large-scale mining facilities required to stay competitive. People are needed to do maintenance on the facilities and equipment. To keep their place in the market, they must also improve their mining capabilities.

For example, in February 2024, one of the biggest mining companies in the world, Marathon Digital Holdings, increased the number of Bitcoins it owned to 16,930 and the number of miners it employed to 231,000. As of March 5, 2024, the company’s hash rate is 28.7 trillion hashes per second, or 5% of the network’s total hash rate.

Anticipations of the upcoming halving and the quantity of hashing power needed to maintain competitiveness while having the money required to fund operations probably contributed to the growth in production capacity and holdings.

Reduced chances correspond with a decline in payout for smaller miners. Even if prices rise, miners in mining pools will probably receive fewer payouts because the reward is being reduced in half. However, unless there is a significant market event, it is unlikely that Bitcoin’s price will double to maintain present profitability.

Consumers

A halving of the value of Bitcoin held by consumers and retail users may have an impact on them. The only things that often effect people who purchase Bitcoin for retail purposes are price changes, which might or might not be the same as they were prior to the halving.

A halving has the same meaning for remittance users of Bitcoin as it does for buyers. Following the halving event, the market price of Bitcoin will determine the amount of their remittances.

When Bitcoin Halved, What Would Happen?

In the context of Bitcoin, “halving” refers to the number of tokens that are awarded. In theory, this is meant to increase demand by simulating declining returns.

Why Do the Halvings Happen Less Frequently Than Every Four Years?

The goal of the Bitcoin mining algorithm is to discover new blocks once every ten minutes.

7.

A block may take ten minutes or less to complete. The time it takes to attain the next halving target may change as a result. To mine the 210,000 blocks needed, for instance, if blocks take 9.66 minutes on average each time, it would take roughly 1,409 days (four years = 1461 days, including one day for a leap year).

What Happens When There Are No More Bitcoins Left?

There is a common belief that the final bitcoin will be mined in 2140. On the other hand, if the reward is divided in half every 210,000 blocks, it will gradually decrease until it equals one satoshi and there are 21 million in total coins in circulation. The smallest unit of currency in Bitcoin, a satoshi is equal to 0.00000001 bitcoin and cannot be divided in half.

The Bottom Line

The pace at which new Bitcoins are put into circulation is halved during a Bitcoin halving. It is anticipated that the rewards program would run until 2140, when the 21 million bitcoin planned maximum will presumably be reached.

50 bitcoins were awarded for mining each block in the chain in 2009. Following the initial halving, the number of bitcoins each block was 25, then 12.5, and as of May 11, 2020, it was 6.25. In April 2024, another halving is anticipated.

The halving of Bitcoin has significant effects on its network. The halving event may cause miners to consolidate in their ranks as smaller companies and lone miners leave the mining ecosystem or are acquired by more powerful entities.

The remarks, viewpoints, and analyses presented on Investopedia are intended only for online informational purposes. For further information, see our liability disclaimer and warranty. The author does not currently possess any Bitcoin as of the date this post was written.

Buy, Sell, and Keep More Than 350 Cryptocurrencies

Participate in the 120 million registered users’ exchange of the most well-known cryptocurrencies worldwide. Buy and sell Binance’s native coin, BNB, also known as Ethereum or Bitcoin. Access to the world’s cryptocurrency marketplaces and some of the lowest costs in the industry are available to all types of traders, from novices to experts. In addition, the Binance app offers tools and tutorials that make it simple to purchase, sell, and convert NFTs in a safe and secure manner.